While no one can debate that it’s hot in the housing market “kitchen”, many Americans are concerned about a potential market crash as demonstrated by the recent 2,450% spike in market-related Google searches. Simply put, concerned U.S. citizens want to know what in the world is driving housing prices to sky high and what it will cost America long term.

Current conditions are richly reminiscent of the 2009 market crash, especially considering the rapidly increasing spike of housing prices in the last five years of 40% above 2012 when we were at our lowest point. We are 4% ahead of the 2006 peak and, if we have learned anything at all, we know we need to seriously question the sustainability of current climbing home prices. Our nation’s glacial unemployment recovery rate and overall high unemployment rate pose major obvious threats to such sustainability.

Do we brace for another economic global catastrophe or are we getting ahead of ourselves?

Suzanne Mistretta, Fitch Ratings senior director, states that sellers throughout the nation are pricing homes at roughly 5.5% above value and that we cannot sustain such prices long-term due to continued high unemployment rates. Industry experts concur stating that while we won’t necessarily see a housing market crash, we can expect home prices to cool off in keeping with current income levels. Current pricing is simply an “unsustainable trend” that cannot withstand current workforce salaries and delayed unemployment recovery.

Last year, when experts expected COVID-19 to level out home prices, quite the opposite occurred. Once real estate endeavors resumed, buyers raced to listings offering suburban space more conducive to remote, home-based lifestyles. City folks also took advantage, relocating to less crowded zip codes on a permanent basis while others elected to buy rural vacation residences from which to work remotely. Naturally, home prices spiked the fastest they have since before the 2009 Recession as buyers prayed for prices to taper down. Even still, supply cannot accommodate current demand and builders have risen to the challenge, resulting in a 12% increase in the new construction of single-family homes. As a result, lumber is also in high demand and more expensive than ever as reflected in new construction price tags.

Twenty-five percent of U.S. metro statistical zip codes are grossly overvalued by 10+%. Nevada, for example, is growing increasingly unsustainable with homes overpriced as high as 29%. Meanwhile, Washington and Rhode Island historically have maintained sustainable increases in pricing, however, they currently hold to an average of as high as 14% overvaluation, lacking the economic capability to sustain such growth rates.

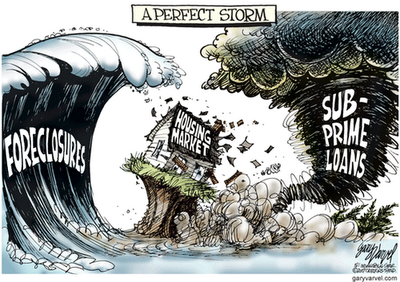

While the increased demand for housing is thought to be COVID-19-related, the current market and the Great Recession are incomparable as today’s circumstances differ from the events which led to the last Recession and lenders are being extremely cautious. Sub-prime lending was largely responsible for the 2009 recession. Lenders were more willing to take risks and didn’t require nearly enough proof that buyers could afford to pay back what they borrowed. In addition, many adjustable-rate mortgages ballooned and homeowners cashed in on their equity via risky refi’s. Lending practices were far more liberal at that time than they are today.

In the current market, lenders are less eager to grant credit and more conservative in underwriting processes. The good news: buyers are much more qualified now than they were 12-14 years ago. In fact, evidence suggests that lenders are loaning to higher credit-scoring borrowers and are justified in doing so as mortgage credit availability dipped significantly, thanks to COVID-19, reaching its lowest point in the past six years.

Changes in pandemic-related lifestyles aren’t the only factors related to increased housing demand. Millennials are turning 30 and are ready to settle down with new spouses, new babies, and new careers in full bloom.

The sunshine state is holding its own with surges in new buyers regardless of the adverse effects of 2009. As a result, single-family housing and townhomes are averaging 17% overpricing with buyers who are still willing to pay thousands above asking. There just isn’t enough inventory to go around.

While many builders filed bankruptcy as a result of events leading to the Great Recession, many are now back in full swing, standing in the gap between supply and demand. In fact, Freddie Mac states the country’s supply is short by roughly 4 million homes, up 50% from 2018, unable to effectively fill the demand for new home buyers. In the meantime, prospective sellers still seem leary regarding certain risk factors which could be associated with selling their homes: increased potential for COVID-19 transmission due to showings and difficulty finding a new property in which to live.

Many questions if the U.S. will experience a spike in pandemic-related foreclosures. Consider this:

- The lending industry continues to experience borrower forbearance – homeowners opting to skip payments or make reduced monthly payments. Over 4 million homeowners were in mortgage forbearance at the end of June.

- Federally mandated borrowing “relief” for the unemployed.

- The recently enacted foreclosure moratorium.

The current forbearance rate is twice what it was during the Great Recession. While the majority of those in forbearance have resumed monthly payments, as usual, the feds have allowed multiple extensions regarding such programs and moratoriums. Over two million Americans were still skipping monthly payments on their mortgages altogether as of April. Unfortunately, it is unknown if those same borrowers will ever be able to resume their regular monthly payments. Were they to default simultaneously, the market would collapse, therefore our fate rests largely in the hands of the federal government, as usual?

It is possible foreclosures could be extended until 2022 if the recent Consumer Financial Protection Bureau proposal goes through. The program would offer homeowners the opportunity to apply for adjustments to the terms of their loans which would ultimately make staying put more affordable for them. In addition, lenders would be held to higher standards of accountability in ensuring borrower protection. Such factors, in combination with Obama, enacted regulations, substantially decrease large-scale foreclosure risks even in the event that some borrows still default.

Bear in mind that rates of forbearance are highest among FHA loan holders as those loans took on greater debt-to-income ratio risks paired with down payment assistance and would be the most likely to face post-COVID-19 default. Markets such as Dallas and Atlanta which contain higher percentages of FHA borrowers are especially at risk for delinquency

If you are a homeowner at risk of delinquency, now might be the time to sell. You’ve established equity and, due to the nationwide housing demand and current overvaluation conditions, you likely stand to profit considerably.

Regarding a possible hike in mortgage rates:

- A 100-basis point dip in rate usually means a 10% uptick in the sale of homes (J.P. Morgan Research).

- Experts state that the opposite can be true as well.

- Affordability remains a problem for many prospective buyers.

- A spike in mortgage rates could bust the market, causing buyers to pause real estate endeavors.

- Experts forecast modest rate increases over the course of 2020, hovering around a steady 3%. Should they climb upward, current home prices will likely stabilize, resulting in greater buyer affordability.

2021 HOUSING MARKET, JACKSONVILLE HOMES FOR SALE, JACKSONVILLE REALTORS, JACKSONVILLE REAL ESTATE MARKET, FIND A HOUSE IN JACKSONVILLE, JACKSONVILLE INVESTMENT PROPERTIES, SELL MY JACKSONVILLE HOUSE, JACKSONVILLE FSBO’S, AITKEN HOME TEAM, BEST REALTORS IN JACKSONVILLE, EXPERIENCED REAL ESTATE AGENT, STATE OF THE MARKET, HOUSING CRISIS